Australian Reinsurance Pool Corporation (ARPC)

Australian Reinsurance Pool Corporation (ARPC)

Cyclone Reinsurance Pool (CRP)

Delivering Better Customer Regulatory Outcomes

Cyclone Reinsurance Pool (CRP)

Delivering Better Customer Regulatory Outcomes

CRP Regulation - A Step-Change for Insurers

CRP Regulation - A Step-Change for Insurers

A Focus on Customer Savings

Exceptions to Mandatory Joining of the Cyclone Pool

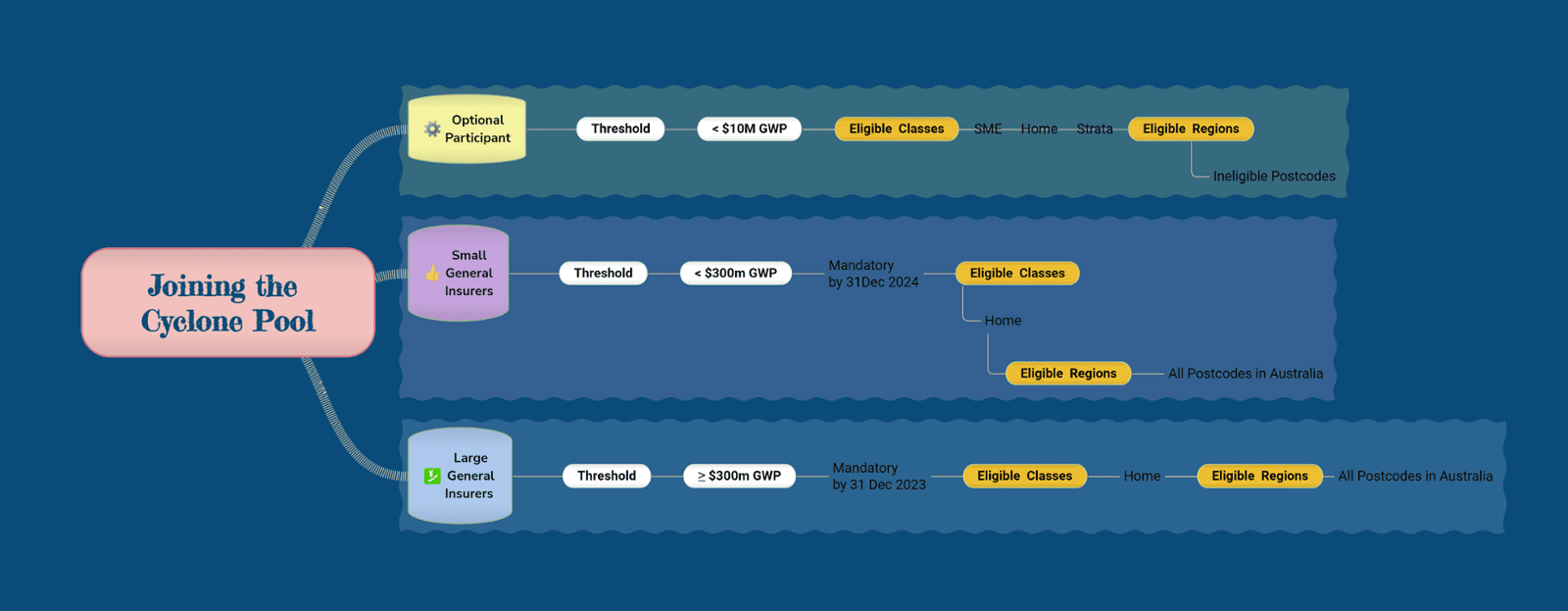

Mandatory, Participation, Thresholds and Transition Arrangements

Large Australian general insurers must enter into a Cyclone Reinsurance Agreement with ARPC before the end of the 2023 calendar year.

Small Australian general insurers, defined as those with less than $300 million gross written premium (GWP) for household insurance for the most recent financial year, must enter into a Cyclone Reinsurance Agreement before the end of the 2024 calendar year.

Exceptions to Mandatory Joining of the Cyclone Pool

Exceptions to Mandatory Joining of the Cyclone Pool

Mandatory, Participation, Thresholds and Transition Arrangements

Mandatory, Participation, Thresholds and Transition Arrangements

Implications of the New CRP Legislation

CRP Legislation Key Details

The Australian Government has established a reinsurance pool to cover damage caused by cyclones and related floods. This pool, which is managed by the Australian Reinsurance Pool Corporation (ARPC), has commenced its operations, and covers all of Australia.

However, it primarily focuses on supporting cyclone-prone areas, which are predominantly located in the northern part of the country.

The Australian Government announced in May 2021 that it plans to create a reinsurance pool to cover the risk of property damage resulting from cyclones and related floods.

On March 30, 2022, Parliament approved the Treasury Laws Amendment (Cyclone and Flood Damage Reinsurance Pool) Bill 2022.

On June 16, 2022, APRA published proposed changes to six general insurance reporting standards, via a letter to the industry, that include APRA's clarification of the treatment of reinsurance recoverables from the Australian Reinsurance Pool Corporation (ARPC) for consultation.

In July 2022, the pool began its operations with the aim of enhancing the accessibility and affordability of insurance for homeowners, strata properties, and small businesses in areas that are prone to cyclones, by reducing the cost of reinsurance.

Insurers are obligated to participate in the scheme, but there is a transition period where large insurers are expected to join by the end of 2023, while smaller insurers are expected to join by the end of 2024. As of now, no insurers have taken up the option of using the pool.

Eligible cyclone related losses include damage that:

- Is caused by a cyclone;

- Commences during a declared cyclone event (declared by the Bureau of Meteorology); and

- Covers damage due to wind, rain, rainwater and rainwater run-off, storm surge and flooding where these hazards are covered under the policyholder’s choice of insurance cover

The ARPC Scheme will apply only to Australian property as follows:

Household/ residential property* - Includes home building cover for standalone and detached homes as well as contents and property owner insurance.

It also covers Strata and small business^ cover.

*No sum insured threshold applies for household residential property.

^ A threshold of 5M applies to small business cover

Are you Ready?

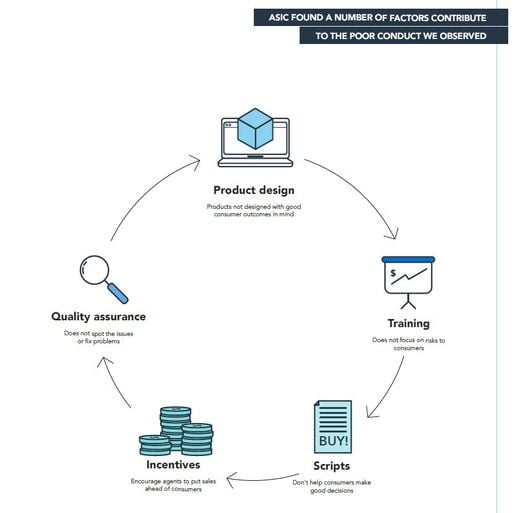

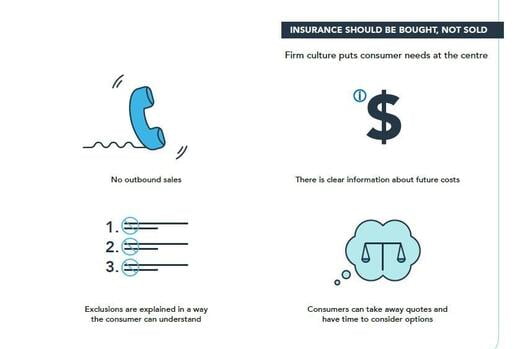

Design and Distribution Obligations

Issuers and Distributors of Financial Products are Affected

ASIC can and will intervene if businesses do not comply

DDO - Issuers

How Can You Define a TMD?

(Click on each highlighted element on the image to see further details)

A target market could initially be determined by asking this question - Is it reasonable to conclude that, if the product were to be sold to a retail client in the target market, is this likely to be aligned with the likely objectives, financial situation and needs of the retail client?

Issuers will need to consider each of the likely objectives, financial situation and needs of consumers in the target market. A product that might be consistent with the likely objectives of consumers in the target market but might not be consistent with the likely financial situation of the target market, and vice versa.

Developing A Compliant TMD

The first design obligation requires an issuer to make a ‘target market determination’ for their product. There are a number of requirements that must be met for such a determination to be validly made. In particular, the target market determination must:

• be in writing

• describe the class of retail clients that comprise the target market for the product (the target market)

• specify any conditions and restrictions on retail product distribution conduct (the distribution conditions)

• specify events and circumstances that would reasonably suggest the determination is no longer appropriate (review triggers)

• specify maximum review periods (review periods)

• specify reporting periods for when complaints about the product should be provided from the distributor to the issuer

• specify kinds of information needed to promptly determine that a determination may no longer be appropriate, along with;

- which distributors should provide those kinds of information; and

- reporting periods for when that information should be provided by the distributors to the issuer

ISSUERS - Taken Reasonable Steps

"risk" can be high if there are financial incentives for a specific distributor to make a sale.

"harm" it is important to asses if products are limited to the financial cost of initial payment, or in the case of an insurance product, a potential high excess.

A "mitigating step" could include further controls on sales and/or trends, perhaps collecting further data on specific questions from a potential customer or follow-up contacts with customers after a sale.

Review Triggers and Review Periods

A review trigger is an event or circumstance which would reasonably suggest that the determination is no longer appropriate, and as part of making the target market determination the issuer must:

• identify events and circumstances (‘review triggers’) that would reasonably suggest that the target market determination is no longer appropriate; and

• determine the maximum period between reviews of the target market determination (called the ‘review period’), which must be reasonable in the circumstances.

• an event or circumstance that would materially change a factor taken into account in making the target market determination for the product;• whether the product is being distributed and purchased as envisaged by its target market determination; and• the nature and extent of any feedback received from those who distribute or acquire the product.

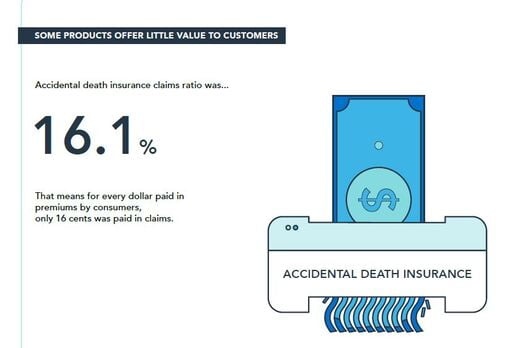

- a high level of complaints relating to a particular product. Note that complaints can be lag indicators and detriment may have already happened. Issuer could also look at lead indicators that can be developed to mitigate the risk detriment or compensation that may need to be paid to customers due to the poor design or the mis-selling of a financial product.

- a potential lead indicator for a bank deposit account can be a high level of inactive accounts opened and for for an insurance product, it may be low levels of claims against premiums or for credit products disproportionate levels of early termination.

Potential Changes to Company Operations, Practices and Third-Party Agreements

In an effort to meet DDO obligation, regulated entities will need to asses and consider substantial changes to existing processes, data, systems and contractual documentation as they implement the obligations.

A product issuer can start defining a target market by assessing if their product as consistent with the objectives, financial situation and needs of a group or ‘class’ of customers. The issuer also needs to specify distribution conditions that will make it likely that consumers who acquire the product are in the target market. Both issuers and distributors must take ‘reasonable steps’ to ensure distribution is consistent with the TMD.

Opposite to providing personal advice, design and distribution obligations do not require product issuers to assess the suitability of products for individual consumers.

Consideration needs to be given to the likely objectives, financial situation and needs of a class of consumers.

Defining a Target Market for a Bundled Product

DDO - Distributors

Obligations for Distributors

(Click on each highlighted element on the image to see further details)

Distributors generally interact directly with the end consumer. A distributor can be an intermediary between the issuer of a financial product and the consumer, or the issuer itself, when the issuer deals directly with consumers.

Like issuers, distributors must take reasonable steps that will, or are reasonably likely to, result in distribution of a financial product being consistent with the TMD for that product

What are reasonable steps for distributors depends on the likelihood of distribution being inconsistent with the TMD, the potential harm that might arise from inconsistent distribution, and the steps that can be taken to mitigate these harms

In some cases, the reasonable steps obligation will require a distributor to collect or review data about consumers. This is not for the purpose of providing individualised advice, but rather to enable the distributor to assess whether a consumer, or group of consumers, is reasonably likely to be in the target market.

Distributors also have obligations to report certain information to issuers, including when there is a significant dealing that is not consistent with the TMD. Distributors must also keep records of distribution information

Taking reasonable steps in relation to distribution

An issuer that distributes its products directly to consumers must comply with both the reasonable steps obligation

In the case of an IDPS platform operator must comply with:

- the issuer’s reasonable steps obligation in relation to interests in the IDPS issued to consumers and

- the distributor’s reasonable steps obligation in relation to the underlying financial products offered on the platform

- A distributor generally must not distribute a financial product unless a TMD has been made for it and the distribution of a product is consistent with the TMD.

- A distributor must have robust product governance arrangements in place to help ensure that it complies with its obligations, including the reasonable steps obligation

- Like an issuer, a distributor must take into account all relevant factors in assessing what reasonable steps need to be taken in the circumstances, these factors include:

(a) risk—the likelihood of the distribution being inconsistent with the TMD;

(b) harm—the nature and degree of harm that might result from the financial product being issued otherwise than in accordance with the TMD; and

(c) mitigation steps—steps that can be taken to eliminate or minimise the likelihood of the distribution being inconsistent with the TMD and the harm that might result

- A distributor must comply with distribution conditions in the TMD for the product and any distribution agreement with the issuer.

ASIC Rules Codifed

DDO Accountability Models

(Click on each highlighted element on the image to see further details)

If your financial institution has been through accountability regimes like BEAR or the FAR legislation, you may be able to leverage current accountability methodologies. Nonetheless, if you have not been through any of these regimes, DDO demands a well-defined form of accountability structure in place. Below we provide a sample DDO accountability methodology model that can be adopted by your firm and may assist in breaking down each specific accountability required to deliver on DDO.

The RACI model clearly lays out roles and responsibilities for any activity or group of activities which will be relevant to the DDO implementation.

A RACI chart (RACI matrix) clarifies roles and responsibilities, making sure that nothing falls through the cracks. RACI charts also prevent confusion by assigning clear ownership for tasks and decisions.A RACI template can easily accommodate larger DDO projects by inserting additional rows and columns.

FSC's Data Standard Definition Template for TMD's

Attributes and Elements of a Codified TMD for Specific Products as Defined by the FSC

(Under BSD 3-Clause License)

FSC's Logical Definition for TMD's

Powered By

Powered By

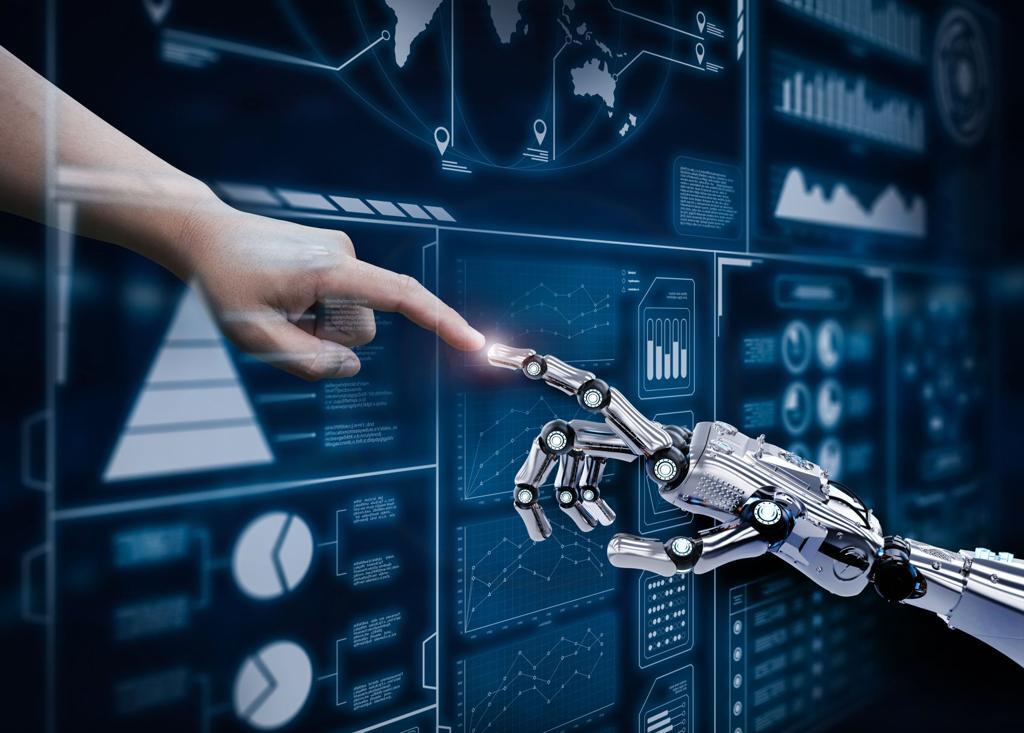

Technology Using a Customer Centric Strategy

Financial services organisation in the context of customer-facing services.

Traditionally, many financial services firms follow a product-oriented, internally focused business strategy model. Their attention is based on a resource-based, cost-efficient creation of products and service which has been designed to target old mass markets with homogenous demands. But we all know that our modern digital markets and customer demands look entirely different now.

In a new world order of expanding customer bargaining power, increasing customer requirements, fierce competition, and cost pressure measures, product-oriented, internally focused strategy model appear totally unsuitable.

Owing to the sharp refocus demanded by ASICs to establish product governance arrangements to address the new targeted and principles-based product design and distribution obligation regime, financial institutions should consider moving away from a cost-base, product‐centric model and towards a customer‐centric approach. Companies that focus on their customers can provide a positive customer experience through their entire journey. To accomplish this, companies may need to undergo a considerable shift in their firm’s structure, business processes, and culture

Using Technology to Address DDO

If you have already started on the journey to become a client-centric organisation we can begin assessing some potential enabling technologies and online solutions that will help address implementation and full compliance with the DDO regime. First port of call would be to look at the technology and processes you currently have and asses if any component could either be duplicated, re-used or leveraged as either an incremental or a complementary solution to also comply with DDO.

For example, we examine if your firm has had to comply with any other governance, compliance or risk related comparable regulations before, these can be legislation as required by:

- NCCP - Credit licensing: Responsible lending conduct

- APRA - Member Outcome Obligations (RSE Licensees)

- AFCA - The Dispute Resolution Systems and Internal Dispute Resolution (IDR & EDR) Procedures

- APRA - Banking Executive Accountability Regime (BEAR)

- Financial Accountability Regimes (BEAR and FAR)

- Mortgage Broker Best Interest Duty

- Future of Financial Advice (FOFA) - Best Interests’ Duty and Related Obligations

- Advice Fee Consent and Independence Disclosure

- General Insurance Code of Practice

- Consumer Data Right Rules (CDR) / Data Sharing Phase 1 & 2

- RCR The Financial Sector Reform – Protecting Consumers

Or any overseas jurisdiction regulation that requires your international branch to comply with, these being:

- Markets in Financial Instruments Directive - MiFID II legislation - ESMA, Europe

- Heightened Supervision for Complex Products, FINRA, USA

- Retail Product Development and Governance — Structured Product review, FCA, UK

- Senior Managers & Certification Regime - SMCR, FCA/PRA, UK

If your firm is complying with some of the above regimes, there is a good likelihood that underlying technology and processes can be augmented and potentially leveraged further. It is also worth noting that some large Australian vendors in financial markets have developed some components that address key areas of DDO compliance – keep an eye on our blogs as we identify and asses some of these key players in the market.

If you feel that you still require to implement new systems and processes in order to satisfy ASIC’s obligation of effective product governance arrangement, we can recommend and implement some leading-edge automated technology and cloud-based collaborative / authoring software as a service (SaaS). These solutions are cost-effective and can be scalable enough to implement a solution that can forge connections while providing great customer experiences.

Contact Discidium here for an initial free consultation

Annual Compliance Costs for the Industry as a Whole to Amount to $94.7 million

Industry concerns about implementation costs could be dealt with by ensuring the obligation builds on good practice, is principles based and is applied on a scaled basis, allowing scope for firms to adapt their existing practices. Thus, the new obligation imposes minimal costs on firms with existing good practices. Some incremental costs for industry may include client categorisation, record keeping, updating documentation and staff training, as well as monitoring changes in the external environment.

The Government assumes that the new DDO Law option delivers benefits to industry, including strengthening internal risk management for product design, which may mitigate future problems, as well as signalling a higher level of customer focus. This approach also avoids new, more complex and interventionist regulation in the future, promoting efficiency in the financial system overall.

Assuming that the new DDO Law option delivers benefits to industry, including strengthening internal risk management for product design, which may mitigate future problems, as well as signalling a higher level of customer focus. This approach also avoids new, more complex and interventionist regulation in the future, promoting efficiency in the financial system overall.

• developing policies and procedures to ensure that they are complying with the new requirements;• changing product review and distribution standards; and

• communicating with other distributors and issuers as relevant.

The costs also include updating IT systems to ensure that existing systems are compliant with requirements and that they will be able to monitor products and customers on an ongoing basis.

Financial Products Under The DDO Law

Financial Products as Defined by:

- PART 6D.2

- PART 7.9

Who is Covered?

Issuers include persons who:

- issue a financial product; and

- must prepare a disclosure document

under the Corporations Act.

Distributors means regulated persons, including:

- AFS licensees;

- authorised representatives;

- credit licensees; and

- credit representatives.

(1) In this Part, financial product means each of the following:

- (a) a financial product (within the meaning of this Chapter) (see section 761A);

- (b) a financial product (within the meaning of Division 2 of Part 2 of the ASIC Act), other than a financial product covered by paragraph (a).

Note: Whether a target market determination is required to be made in relation to financial products covered by this extended definition is determined under section 994B, including any regulations made for the purposes of paragraph 994B(3)(f).

(2) In determining the meaning of a term used in a provision of this Part (other than this section), treat a reference in this Act to a financial product as being a reference to a financial product within the meaning of subsection (1) of this section.

Requirement to make a target market determination

(1) Subject to subsection (3), a person must make a target market determination for a financial product if:

(a) under Part 6D.2, the person is required to prepare a disclosure document for the product; or

(b) under Part 7.9, the person is required to prepare a Product Disclosure Statement for the product; or

(ba) the product is covered by paragraph 994AA(1)(b) (about the extended operation of this Part) and:

(i) the person issues the product to another person as a retail client; or

(ii) the person sells the product under a regulated sale; or

(c) regulations made for the purpose of this paragraph require the person to make a target market determination for the product.

(2) A person required by subsection (1) to make a target market determination for a financial product must do so before:

(a) if paragraph (1)(a), (b) or (ba) applies—any person engages in retail product distribution conduct in relation to the product; or

(b) if paragraph (1)(c) applies:

(i) the time or event specified in regulations made for the purposes of that paragraph; or

(ii) if there is no time or event so specified—any person engages in retail product distribution conduct in relation to the product.

Note 1: Failure to comply with this subsection is an offence (see subsection 1311(1)).

Note 2: This subsection is also a civil penalty provision (see section 1317E). For relief from liability to a civil penalty relating to this subsection, see section 1317S.

(3) Subsections (1) and (2) do not apply to:

(a) a MySuper product; or

(b) a margin lending facility; or

(c) a security that has been or will be issued under an employee share scheme; or

(d) a fully paid ordinary share in a company or a foreign company (except a fully paid ordinary share covered by subsection (4)); or

(e) a financial product issued, or offered for regulated sale, by an exempt body or an exempt public authority; or

(f) a financial product of a kind prescribed by regulations made for the purposes of this paragraph.

(4) Paragraph (3)(d) does not apply to a fully paid ordinary share in a company or a foreign company if:

a) on the issue of the share, the company intended that the share be converted into a preference share within 12 months after the date of issue; or

(b) the company:

(i) carries on a business of investment in financial products, interests in land or other investments; and

(ii) in the course of carrying on that business, invests funds subscribed, whether directly or indirectly, after an offer or invitation to the public (within the meaning of section 82) made on terms that the funds subscribed would be invested.

Requirements for target market determinations

(5) A target market determination for a financial product must:

(a) be in writing; and

(b) describe the class of retail clients that comprises the target market (within the ordinary meaning of the term) for the product; and

(c) specify any conditions and restrictions on retail product distribution conduct in relation to the product (distribution conditions), other than a condition or restriction imposed by or under another provision of this Act; and

(d) specify events and circumstances (review triggers) that would reasonably suggest that the determination is no longer appropriate; and

(e) specify the maximum period from the start of the day the determination is made to the start of the day the first review of the determination under section 994C is to finish; and

(f) specify the maximum period from the start of the day a review of the determination under section 994C is finished to the start of the day the next review of the determination is to finish; and

(g) specify a reporting period for reporting information about the number of complaints about the product (see subsection 994F(4)); and

(h) specify the kinds of information needed to enable the person who made the target market determination to identify promptly whether a review trigger for the determination, or another event or circumstance that would reasonably suggest that the determination is no longer appropriate, has occurred and, for each kind of information, specify:

(i) the regulated person or regulated persons that, under subsection 994F(5), are required to report the information to the person who made the determination; and

(ii) a reporting period for reporting the information under subsection 994F(5).

- Note 1: For paragraph (c), an example of a distribution condition for a financial product is a restriction limiting the distribution of the product to specified methods of distribution.

- Note 2: The requirements of this subsection also apply when a new target market determination is made as a result of a review under section 994C.

(6) A period specified under paragraph (5)(e) or (f), and a reporting period specified under paragraph (5)(g) or subparagraph (5)(h)(ii), must be reasonable.

(7) In determining what is reasonable for the purposes of subsection (6), regard must be had to:

(a) the need to identify promptly whether a review trigger for the determination, or another event or circumstance that would reasonably suggest that the determination is no longer appropriate, has occurred; and

(b) the likelihood, nature and extent of detriment to retail clients that may result if:

(i) a review trigger for the determination, or another event or circumstance that would reasonably suggest that the target market determination is no longer appropriate, has occurred; and

(ii) the target market determination is not promptly reviewed.

(8) A target market determination for a financial product must be such that it would be reasonable to conclude that, if the product were to be issued, or sold in a regulated sale:

(a) to a retail client in accordance with the distribution conditions—it would be likely that the retail client is in the target market; and

(b) to a retail client in the target market—it would likely be consistent with the likely objectives, financial situation and needs of the retail client.

Making target market determinations public

(9) A person who makes a target market determination must ensure that the determination is available to the public free of charge.

- Note 1: Contravention of this subsection is an offence (see subsection 1311(1)).

- Note 2: This subsection is also a civil penalty provision (see section 1317E). For relief from liability to a civil penalty relating to this subsection, see section 1317S.

- Note 3: This subsection applies to all target market determinations, including those that have ceased to apply.

PART 6D.2----DISCLOSURE TO INVESTORS ABOUT SECURITIES (OTHER THAN FOR CSF OFFERS)

Division 1--Overview

703B. Part generally does not apply in relation to CSF offers

704. When disclosure to investors is needed

705. Types of disclosure document

Division 2--Offers that need disclosure to investors

706. Issue offers that need disclosure

707. Sale offers that need disclosure

708. Offers that do not need disclosure

708AA. Rights issues that do not need disclosure

708A. Sale offers that do not need disclosure

Division 3--Types of disclosure documents

709. Prospectuses, short-form prospectuses, profile statements and offer information statements

Division 4--Disclosure requirements

710. Prospectus content--general disclosure test

711. Prospectus content--specific disclosures

712. Prospectus content--short form prospectuses

713. Special prospectus content rules for continuously quoted securities

713A. Offer of simple corporate bonds

713B. Simple corporate bonds--2-part simple corporate bondsprospectus

713C. Simple corporate bonds--base prospectus

713D. Simple corporate bonds--offer-specific prospectus

713E. Simple corporate bonds--prospectus may refer to other material lodged with ASIC

714. Contents of profile statement

715. Contents of offer information statement

715A. Presentation etc. of disclosure documents

716. Disclosure document date and consents

Division 5--Procedure for offering securities

717. Overview of procedure for offering securities

718. Lodging of disclosure document

719. Lodging supplementary or replacement document--general

719A. Lodging supplementary or replacement document--2-part simple corporate bondsprospectus

720. Consents needed for lodgment

721. Offer must be made in, or accompanied by, the disclosure document

722. Application money to be held on trust

723. Issuing or transferring the securities under a disclosure document

724. Choices open to person making the offer if disclosure document condition not met or disclosure document defective

725. Expiration of disclosure document

CHAPTER 7--Financial services and markets

PART 7.9----FINANCIAL PRODUCT DISCLOSURE AND OTHER PROVISIONS RELATING TO ISSUE, SALE AND PURCHASE OF FINANCIAL PRODUCTS

Division 1--Preliminary

1010A. Part generally does not apply tosecurities

1010B. Part does not apply tofinancial products not issued in the course of a business

1010BA. Part does not apply to contribution plans

1010C. Special provisions about meaning of sale and offer

1010D. General approach to offence provisions

Division 2--Product Disclosure Statements

Subdivision A--Preliminary

1011A. Jurisdictional scope of Division

1011C. Treatment of offers of options over financial products

Subdivision B--Requirement for a Product Disclosure Statement to be given

1012A. Obligation to give Product Disclosure Statement--personal advice recommending particular financial product

1012B. Obligation to give Product Disclosure Statement--situations related to issue of financial products

1012C. Obligation to give Product Disclosure Statement--offers related to sale of financial products

1012D. Situations in which Product Disclosure Statement is not required

1012DAA.Rights issues for which Product Disclosure Statement is not required

1012DA. Product Disclosure Statement not required for sale amounting to indirect issue

1012E. Small scale offerings of managed investment and other prescribed financial products (20 issues or sales in 12 months)

1012F. Product Disclosure Statement for certain superannuation products may be provided later

1012G. Product Disclosure Statement may sometimes be provided later

1012H. Obligation to take reasonable steps to ensure that Product Disclosure Statement is given to person electing to be covered by group financial product

1012I. Obligation to give employer a Product Disclosure Statement in relation to certain superannuation products and RSA products

1012IA. Treatment of arrangements under which a person can instruct another person to acquire a financial product

1012J. Information must be up to date

1012K. Anti-avoidance determinations

Subdivision C--Preparation and content of Product Disclosure Statements

1013A. Who must prepare Product Disclosure Statement

1013B. Title of Product Disclosure Statement

1013C. Product Disclosure Statement content requirements

1013D. Product Disclosure Statement content--main requirements

1013DA. Information about ethical considerations etc.

1013E. General obligation to include other information that might influence a decision to acquire

1013F. General limitations on extent to which information is required to be included

1013FA. Information not required to be included in PDS for continuously quoted securities

1013G. Product Disclosure Statement must be dated

1013GA. Extra requirements if Product Disclosure Statement relates to foreign passport fund products

1013H. Requirements if Product Disclosure Statementstates or implies that financial productwill be able to be traded

1013I. Extra requirements if Product Disclosure Statement relates to managed investment products that are ED securities

1013IA. Extra requirements if Product Disclosure Statement relates to foreign passport fund products that are ED securities

1013J. Requirements if Statement has been lodged with ASIC

1013K. Requirements relating to consents to certain statements

1013L. Product Disclosure Statement may consist of 2 or more separate documents given at same time

1013M. Combining a Product Disclosure Statement and a Financial Services Guide in a single document

Subdivision D--Supplementary Product Disclosure Statements

1014A. What a Supplementary Product Disclosure Statement is

1014B. Title of Supplementary Product Disclosure Statement

1014C. Form of Supplementary Product Disclosure Statement

1014D. Effect of giving person a Supplementary Product Disclosure Statement

1014E. Situation in which only a Supplementary Product Disclosure Statement need be given

1014F. Application of other provisions in relation to Supplementary Product Disclosure Statements

Subdivision DA--Replacement Product Disclosure Statements

1014G. Application of this Subdivision--stapled securities

1014H. What a Replacement Product Disclosure Statement is

1014J. Consequences of lodging a Replacement Product Disclosure Statement

1014K. Form, content and preparation of Replacement Product Disclosure Statements

1014L. Giving, lodgment and notice of Replacement Product Disclosure Statements

Subdivision E--Other requirements relating to Product Disclosure Statements and Supplementary Product Disclosure Statements

1015A. Subdivision applies to Product Disclosure Statements and Supplementary Product Disclosure Statements

1015B. Some Statements must be lodged with ASIC

1015C. How a Statement is to be given

1015D. Notice, retention and access requirements for Statement that does not need to be lodged

1015E. Altering a Statement after its preparation and before giving it to a person

Subdivision F--Other rights and obligations related to Product Disclosure Statements

1016A. Provisions relating to use of application forms

1016B. If Statement lodged with ASIC, financial product is not to be issued or sold before specified period

1016C. Minimum subscription condition must be fulfilled before issue or sale

1016D. Condition about ability to trade on a market must be fulfilled before issue or sale

1016E. Choices open to person making the offer if disclosure condition not met or Product Disclosure Statement defective

1016F. Remedies for person acquiring financial product under defective Product Disclosure Document

Division 3--Other disclosure obligations of the issuer of a financial product

1017A. Obligation to give additional information on request

1017B. Ongoing disclosure of material changes and significant events

1017BA. Trustees of regulated superannuation funds--obligation to make product dashboard publicly available

1017BB. Trustees of registrable superannuation entities--obligation to make information relating to investment of assets publicly available

1017C. Information for existing holders of superannuation products and RSA products

1017D. Periodic statements for retail clients for financial products that have an investment component

1017DA. Trustees of superannuation entities--regulations may specify additional obligations to provide information

1017E. Dealing with money received for financial product before the product is issued

1017F. Confirming transactions

1017G. Certain product issuers and regulated persons must meet appropriate dispute resolution requirements

Division 4--Advertising for financial products

1018A. Advertising or other promotional material for financial product must refer to Product Disclosure Statement

1018B. Prohibition on advertising personal offers covered by section 1012E

Division 5--Cooling-off periods

1019A. Situations in which this Division applies

1019B. Cooling-off period for return of financial product

Division 5A--Unsolicited offers to purchase financial products off-market

1019D. Offers to which this Division applies

1019E. How offers are to be made

1019F. Prohibition on inviting offers to sell

1019G. Duration and withdrawal of offers

1019H. Terms of offer cannot be varied

1019I. Contents of offer document

1019J. Obligation to update market value

1019K. Rights if requirements of Division not complied with

Division 5B--Disclosure etc

1020AB. Seller disclosure

1020AC. Licensee disclosure

1020AD. Public disclosure of information

1020AE. Licensee's obligation to ask seller about short sale

1020AF. Regulations

Division 5C--Information about CGS depository interests

1020AG. Jurisdictional scope of Division

1020AI. Requirement to give information statements for CGS depository interest if recommending acquisition of interest

1020AJ. Information statement given must be up to date

1020AK. How an information statement is to be given

1020AL. Civil action for loss or damage

Division 6--Miscellaneous

1020A. Offers etc. relating to certain managed investment schemes not to be made in certain circumstances

1020BAA.Offers etc. relating to foreign passport funds not to be made in certain circumstances

1020B. Prohibition of certain short sales of securities, managed investment products, foreign passport fund products and certain other financial products

1020D. Part cannot be contracted out of

1020E. Stop orders by ASIC

1020F. Exemptions and modifications by ASIC

1020G. Exemptions and modifications by regulations

Division 7--Enforcement

Subdivision A--Offences

1021A. Overview

1021C. Offence of failing to give etc. a disclosure document or statement

1021D. Offence of preparer of defective disclosure document or statement giving the document or statement knowing it to be defective

1021E. Preparer of defective disclosure document or statement giving the document or statement (whether or not known to be defective)

1021F. Offence of regulated person (other than preparer) giving disclosure document or statement knowing it to be defective

1021FA. Paragraph 1012G(3)(a) obligation--offences relating to communication of information

1021FB. Paragraph 1012G(3)(a) obligation--offences relating to information provided by product issuer for communication by another person

1021G. Financial services licensee failing to ensure authorised representative gives etc. disclosure documents or statements as required

1021H. Offences if a Product Disclosure Statement (or Supplementary PDS) does not comply with certain requirements

1021I. Offence of giving disclosure document or statement that has not been prepared by the appropriate person

1021J. Offences if preparer etc. of disclosure document or statement becomes aware that it is defective

1021K. Offence of unauthorised alteration of Product Disclosure Statement (or Supplementary PDS)

1021L. Offences of giving, or failing to withdraw, consent to inclusion of defective statement

1021M. Offences relating to keeping and providing copies of Product Disclosure Statements (or Supplementary PDSs)

1021N. Offence of failing to provide additional information requested under section 1017A

1021NA. Offences relating to obligation to make product dashboard publicly available

1021NB. Offences relating to obligation to make superannuation investment information publicly available

1021O. Offences of issuer or seller of financial product failing to pay money into an account as required

1021P. Offences relating to offers to which Division 5A applies

Subdivision B--Civil liability

1022B. Civil action for loss or damage

1022C. Additional powers of court to make ordersVisualise DDO Obligations & PIP Amendments

(Drag and Expand a Tree Section - Green Box is the Root)

Need Help with DDO Implementations?

Contact Us

Crypto

Payments

Open Banking

Lending

Neobank

Wealthtech

Insurtech

Token Issuer

Exchange

Wallets/Cards

Card Acquiring

Data Recipient

Intermediary

Consumer Lending

SME Lending/Invoice Financing

Buy Now Pay Later

Eg. Lending + Deposits

Eg. Roboadvice

Eg. Distribution, Risk Rating

Typically not required (except for security tokens, derivatives)

Required (NCPF)

Not Required *

Not Required *

Typically not required (except for marketplace lending)

Typically not required

Required (banking)

Required (advice/deal)

Required (advice/deal)

Not Required *

Typically not required (unless credit)

Not Required *

Not Required *

Required (lender/broker)

Not Required *

Required (lender/broker)

Not Required *

Not Required *

APRA/RBA regulation, depending on volume

ACCC accreditation required

APRA licensing required for full banking services

APRA required for insurers (not distributors)

Required (fiat <> crypto)

Required

Required (scheme member)

Not Required *

Required

Required

Required

Required

AFSL

ACL

Other

AML